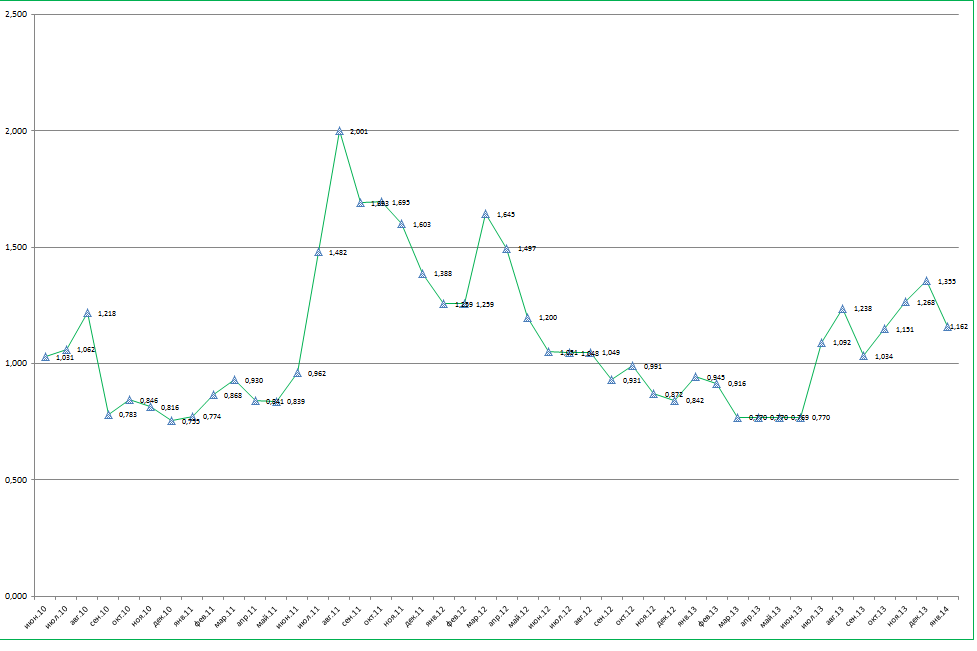

Sea-river index introduction. Dear friends, As our industry is from one side very special one connected with precise quantity of specific tonnage and from the other hand touches Black sea coaster market we would like to introduce our index showing possible earning per mt of dwcc of regular sea-river 3000 tonner for round voyage without back loading from Azov to Egypt Med. Daily earnings shows how shipowners feel themselves in particular moment of time. Holding freight statistics since 2001 we took year 2004 freight rates as zero level in respect of inflation. Considering MGO price correlation with oil price as linear and correcting USD prices with official inflation rate in USA we can get real earning of shipowner during the round voyage. Duration of round voyage in our model is 26 days of which 16 days of steaming time and 10 days of port/idle time. D/a amount in total approximated to USD 15000,- including channel dues. Fuel consumption taken as 3,- mt mgo while steaming and 0,5 mt mgo while idle. So round voyage fuel consumtion is 55,- mt As far as market has strong correlation with agricultural products supply season in our model means agricultural year July/June period. Using the above find below three diagrams showing sea-river market during last 3 seasons (as those happened after 2007/08 crisis)